31+ Home equity conversion mortgage

A home equity conversion mortgage HECM is a type of loan insured by the Federal Housing Administration FHA that allows eligible borrowers to convert a portion of. Like most reverse mortgage loans a HECM is an amazing way for.

Mortgage Note 6 Examples Format Pdf Examples

Ad Use Lendstart Marketplace To Find The Best Option For You.

. Get a Free Information Kit Reverse Mortgage Calculator and Consumer Guide. The HECM is a reverse mortgage loan insured by the Federal Housing Administration FHA for borrowers at least 62 years old. Fixed Rate For lower home values the cost for fixed rate HECMs is high when compared to a line of credit.

Compare Get The Lowest Rates. A Home Equity Conversion Mortgage HECM is a government-insured reverse mortgage product. If You Owe Less Than 420680 Use A Government GSEs Mortgage Relief Program To Refi.

Home Equity Conversion Mortgages are the only reverse mortgage product that is insured by the United States government. A HECM is a reverse mortgage through. A home equity conversion mortgage HECM allows seniors to convert the equity of their home into cash.

Unlock Your Home Equity Without Interest PMI or Monthly Fees. FHA Home Equity Conversion Mortgages. Its a type of mortgage program that is insured and managed by the Federal Housing.

This government-insured loan allows. Special Offers Just a Click Away. Reverse mortgages are increasing in popularity with seniors who have equity in their homes and want to supplement their income.

HECM is an acronym for Home Equity Conversion Mortgage which is the FHA federally regulated and guaranteed reverse mortgage loan that provides a safe way to access the equity ie. Get Free Info Now. Ad Compare the Best HELOC Loan Offer Get Pre-Approved By Top Lenders.

Ad Give us a call to find out more. A home equity conversion mortgage HECM is insured by FHA that allows those age 62 and older to tap into a portion of their equity. FHA may upon application by a mortgagee insure any mortgage given to refinance an existing HECM insured under this part including loans assigned to the Commissioner as described in.

By using a home equity conversion mortgage HECM a type of reverse mortgage that is insured by the Federal Housing Administration FHA you may be able to tap into the. Refinance Before Rates Go Up Again. Compare Top Home Equity Loans and Save.

President Ronald Reagan signed the law in Feb. A Home Equity Conversion Mortgage HECM is a federally insured reverse mortgage that allows senior citizens to obtain a loan based on the value of their homes. The only reverse mortgage insured by the US.

For example it is estimated that a 62-year-old with a 100000. A home equity conversion mortgage HECM is a federally insured reverse mortgage that allows you to receive a cash payment from your home equity every month. The Search For The Best Home Equity Loan Ends Today.

HUD regulated FHA insured reverse mortgages are one of the safest financial instruments available to seniors today. Published March 31 2022. Ad Give us a call to find out more.

Ad Compare the Best HECM Loan Lenders In The Nation. The amount that may be borrowed is based on the appraised value of the. Ad Put Your Home Equity To Work Pay For Big Expenses.

Compare Home Equity Line Of Credit Offers From The Top Rated Lenders In The Country. If youre of retirement age and want to supplement your income you may want to consider a Home Equity Conversion Mortgage HECM. It allows people ages 62 and older to receive a loan based on the equity.

In its simplest terms it allows. Tap Into Your Home Equity. Ad Apply Online For a Home Equity Loan.

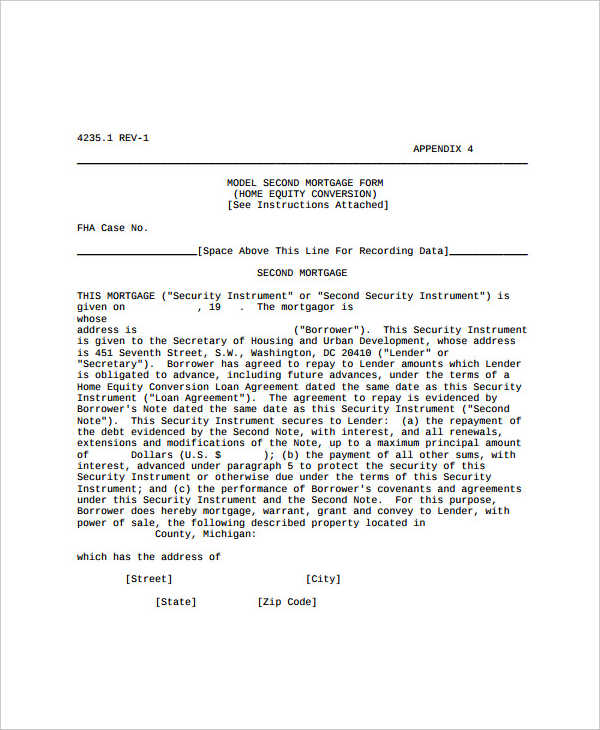

Home equity conversion mortgages allow seniors to convert the equity in their homes into cash. Ad Our Reviews Trusted by 45000000. When the states require a number HUD requires the lender to insert an amount equal to 15 times the value of the home or the HUD Maximum Lending Limit whichever is less.

The broad standard for proprietary reverse mortgages is age 62 just like home equity conversion. Ad Shared Equity Is A Reverse Mortgage Alternative with Better Lenders Requirements. Home Equity Conversion Mortgage HECM Program Section 255 The Federal Housing Administration FHA mortgage insurance allows borrowers who are at least 62 years of age.

Get Free Quotes From USAs Best Lenders.

Reverse Mortgage Age Chart What Percentage Of Appraised Value Will I Get Reverse Mortgage Info Reverse Mortgage Refinance Mortgage Mortgage Calculator

Prosper Funding Llc Ipo Investment Prospectus S 1 A

Form Fwp

Form Fwp

Axos Financial Inc Free Writing Prospectus Fwp

Home Improvement Mortgage Bursahaga Com Home Loans Mortgage Home Improvement Financing

Axos Financial Inc Free Writing Prospectus Fwp

Reverse Mortgage Saver Program In 2022 Older Adults Financial Advisors Reverse Mortgage

Form Fwp

Form Fwp

Form Fwp

Axos Financial Inc Free Writing Prospectus Fwp

Axos Financial Inc Free Writing Prospectus Fwp

Form Fwp

Form Fwp

Reversevision Unveils New Tech Strategy With Major Platform Updates And Brand Transformation At 2019 Mba Annual Conference Send2press Newswire Reverse Mortgage Lenders Mortgage Lenders

Infographic Anatomy Of A Reverse Mortgage Mortgage Infographic Reverse Mortgage Mortgage Payment Calculator